Published on: June 21st, 2025

|

|

|

Hey, Pro Briefers!

On June 6th, President Trump signed an executive order. Its goal? To unleash American Drone Dominance.

No, really - that’s its title.

The order claims it will create high-paying jobs and reshape the future of aviation.

And the President didn’t stop there, on June 11th, he signed additional executive orders aimed at jumpstarting the drone, flying car, and supersonic industries.

|

|

Data via The White House |

|

What does this mean? Our analysts spoke to a number of drone industry experts, including United Nations AI advisor, Neil Sahota, and he put it plainly:

“This will launch the low-altitude economy.”

And that’s where we’ve identified a Government Shift: The White House is signing legislation to jumpstart the commercial drone industry.

Drone makers, software firms, and service providers are set to gain from new regulations.

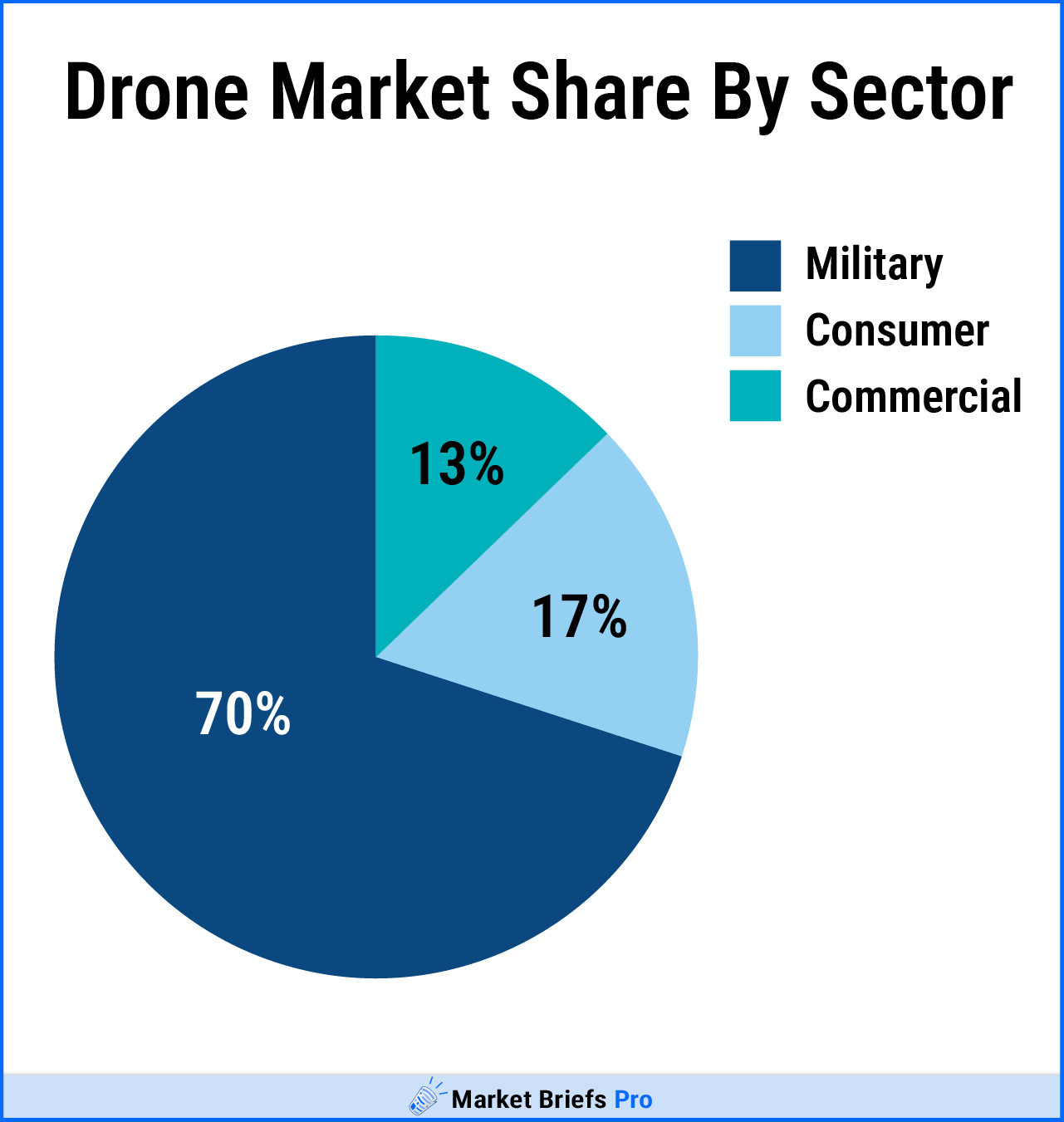

The drone industry is nothing new, but until recently, the drone business has largely been for military use. |

|

Data via Goldman Sachs |

|

What’s being called the “low-altitude economy” is commercial companies and businesses that fly objects lower to the ground - think anything below a helicopter.

Businesses have been talking about using drones for years, and now, President Trump is looking to make it happen.

This order will also benefit the defense sector.

While it launches a new commercial industry, the provisions and regulations provided by these orders should also make things easier for military drone producers.

Think of it as a tide that raises all ships in the sea of drones.

In this week’s report, we’re going to dive into the newly created commercial done industry, some of the companies driving it, and even some private companies that might be looking at an IPO after these orders. |

|

|

How did we do? Reply directly to this newsletter to let us know how you took action with this shift!

|

|

|

TECH |

Digital Infrastructure

All drones need some kind of digital infrastructure - think of it as a kind of air traffic control. Without it? There can be serious problems.

A water-dropping plane was grounded during the 2025 Palisades fires in Los Angeles.

Why? It struck a recreational drone.

So how do we prevent this sort of thing from happening when hundreds, if not thousands of drones are flying around a city?

Neil weighs in:

“We can actually use old school technology…airports in rural areas, they don’t have air traffic control towers. What they do is that pilots have a communication system where they alert each other as to where they are…using beacon technology or old school radar, or GPS stuff, that drone will know exactly where the other drones are around them.”

To understand more about this software, our analysts spent the day at the offices of Airspace Link.

Airspace Link specializes in exactly that. Radar that monitors every drone in the air through the unique signals they broadcast.

|

|

Image via Airspace Link |

|

Their system is linked directly to the Federal Aviation Administration (FAA), and is one of the few vendors that helps establish this nationwide “air traffic control” for drones.

Airspace Link is a private company, but in our conversation with their President and CEO Michael Healander, it seemed like that might not be the case for long.

When asked if they had plans on going public, Michael detailed their 3-year plan, which would include either an acquisition or an IPO.

He said the industry will see “a lot of mergers and acquisitions” over the next year, and the remaining players could move towards IPOs.

While he couldn’t give us exact details about ongoing deals in the industry, one thing was clear - we would start to see early adopters (such as Detroit) with commercial drone operations in the next year.

Nationwide services and major IPOs for commercial drone companies are about 3 years away.

So what are some of those services? |

|

|

TRANSPORTATION |

Drone Taxis

Commercial drones are quite a bit different from their military counterparts.

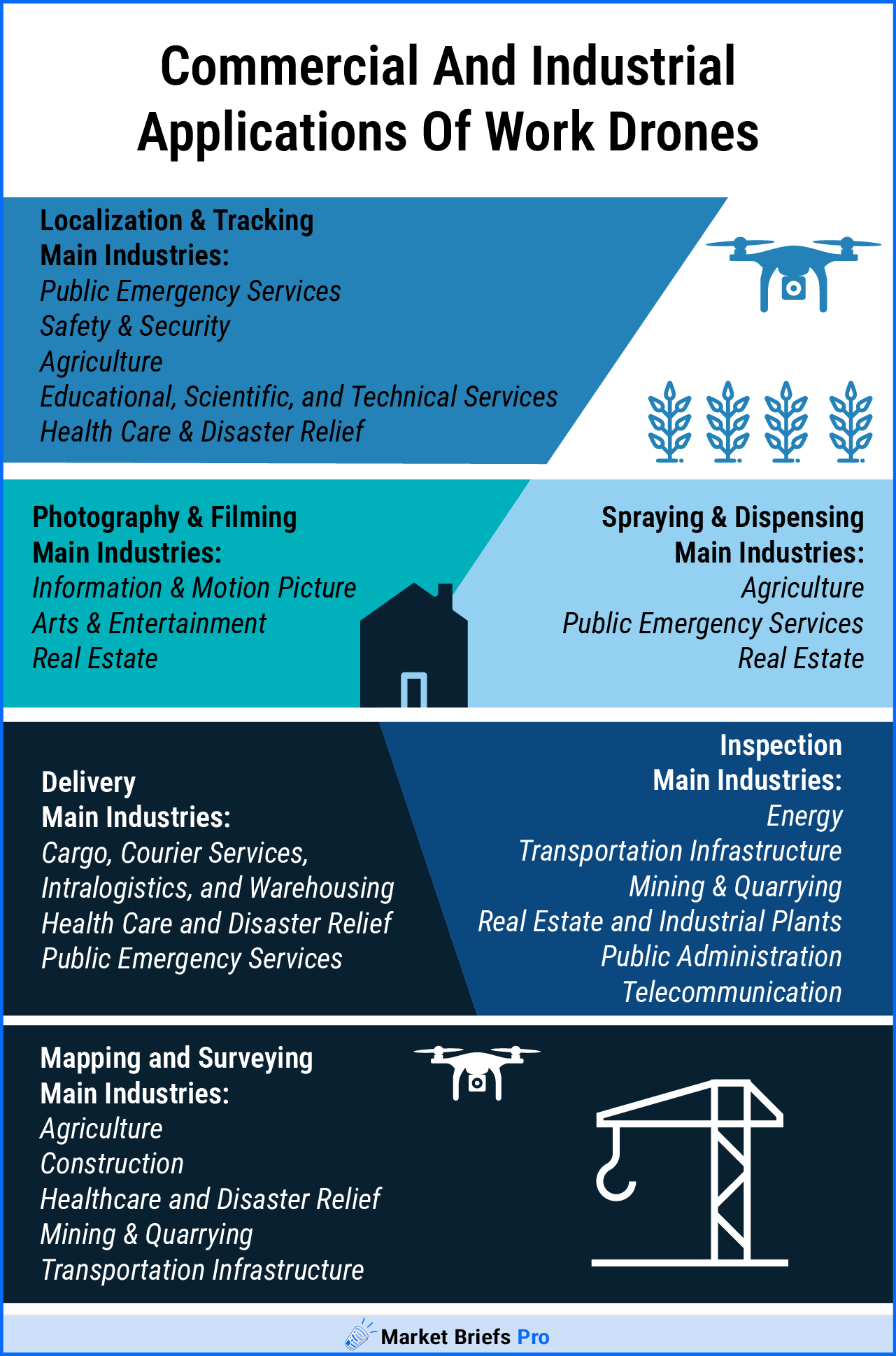

They fly lower to the ground (limited to 400 feet by the FAA), and cover a wide range of tasks such as:

|

|

Data via Drone Industry Insights |

|

These tasks? They all need different types of drones.

The wide variety has created an opportunity for a number of different drone manufacturers.

One of the most ambitious of these drone companies is Joby Aviation (JOBY). Joby is trying to take low-altitude drones to the next level.

Rather than a small unmanned vehicle with a camera or cargo compartment, they’re developing drones for human transportation.

Wait, like a flying car? Yes, Joby is looking to capitalize on the executive orders to bring us the flying cars from The Jetsons - at least for taxi services.

|

|

Image via Joby Aviation |

|

Joby has been establishing itself in the existing transportation business, forming partnerships with companies like Delta (DAL) and Uber (UBER).

And the executive orders around both drones and flying cars were big days for the company’s share price. |

|

Data via Yahoo! Finance |

-

Shares of Joby are up more than 20% in the past month, spiking with the executive order on June 6th, 2025, and peaking with the following order on June 11th.

Not ready for takeoff: Despite a rally alongside the President’s orders, Joby isn’t quite ready to take to the skies.

They’ve been burning through their cash reserves as part of the R&D process, and there’s one final roadblock between them and launching commercial services - an FAA certification.

Before the FAA allows Joby to fly people around in their drones, they have to pass a 5-step certification process.

Joby has currently completed 4 of the 5 steps, all that remains is a series of test flights, which they began in late 2024.

One of the reasons that shares of Joby saw a boost alongside Trump’s order, is that experts believe the President is looking to eliminate bureaucratic roadblocks.

This could mean that Joby gets certified even faster.

While we don’t know whether or not people will embrace the idea of drone cars, Joby should see significant growth once their FAA certification is finished. |

|

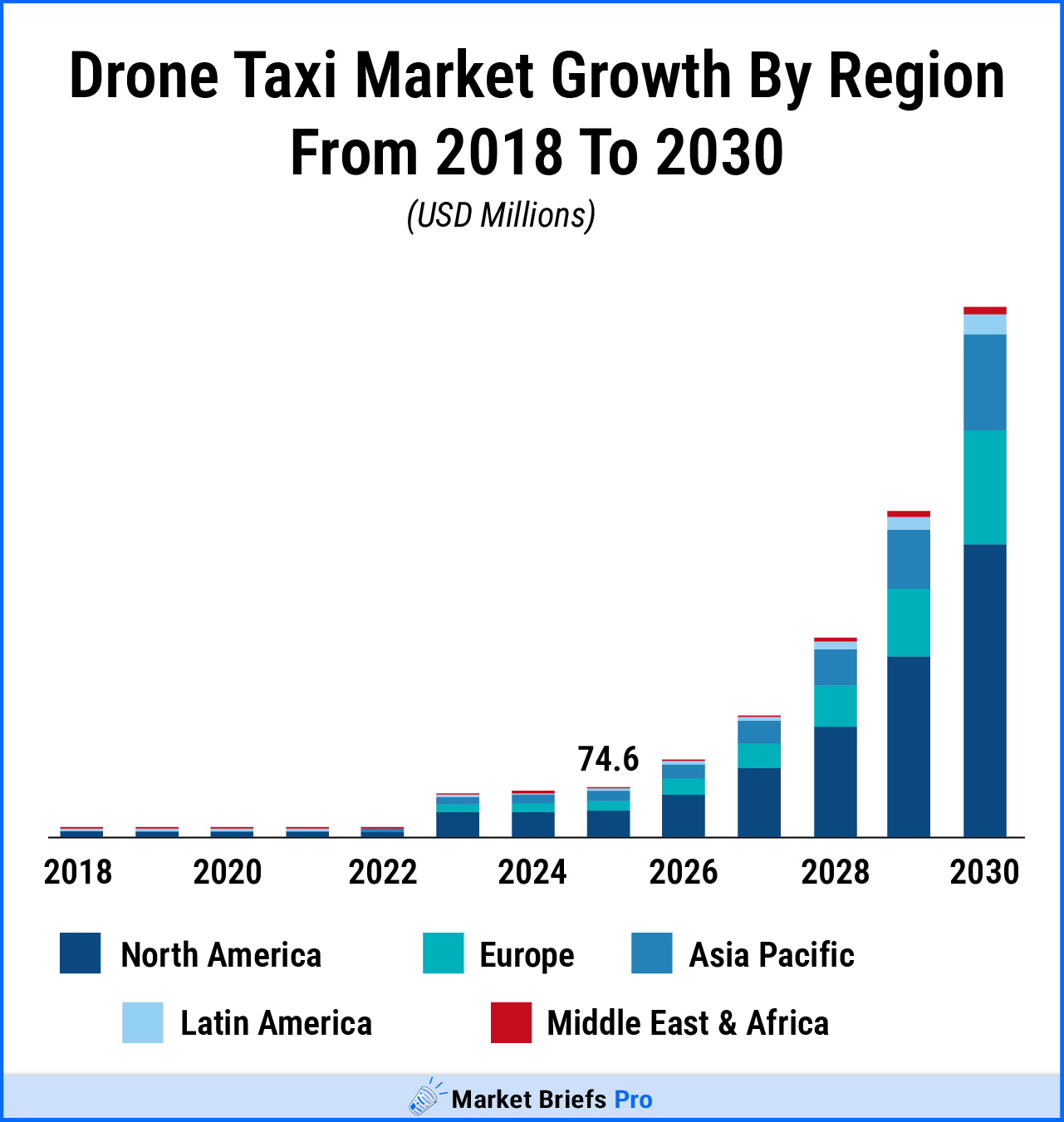

Data via Polaris |

|

While drone taxis currently aren’t approved in the U.S., the market for them is projected to show massive growth once the approvals are set.

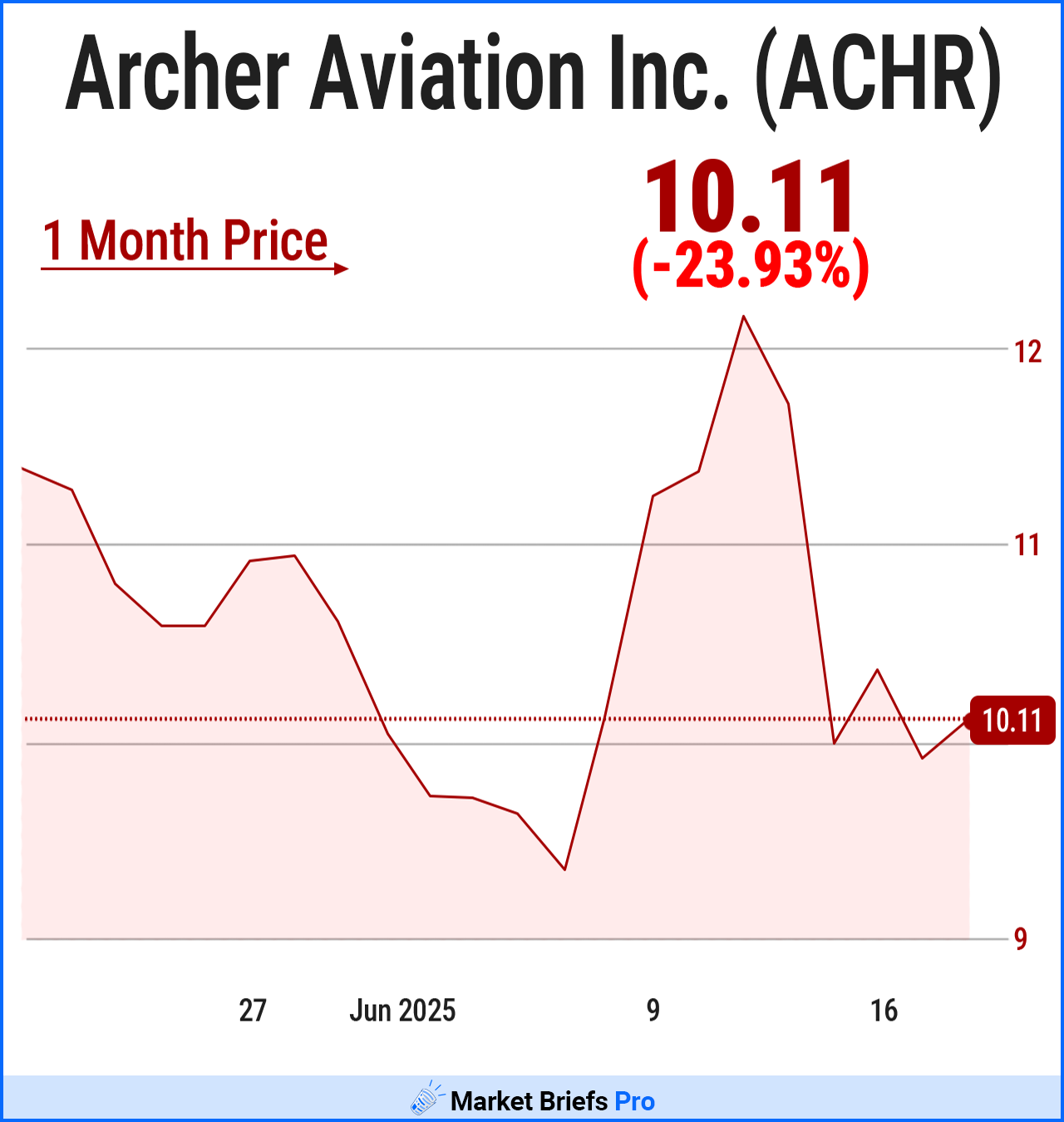

Drone taxi dogfight: Joby isn’t the only drone taxi company awaiting FAA approval. Archer Aviation (ACHR) is another company on step 5 of the approval process.

A competitor to Joby, Archer is partnered with companies like United Airlines. Archer had a similar spike in share price on the 6th, and has raised over $800 million in new funds. |

|

Data via Yahoo! Finance |

|

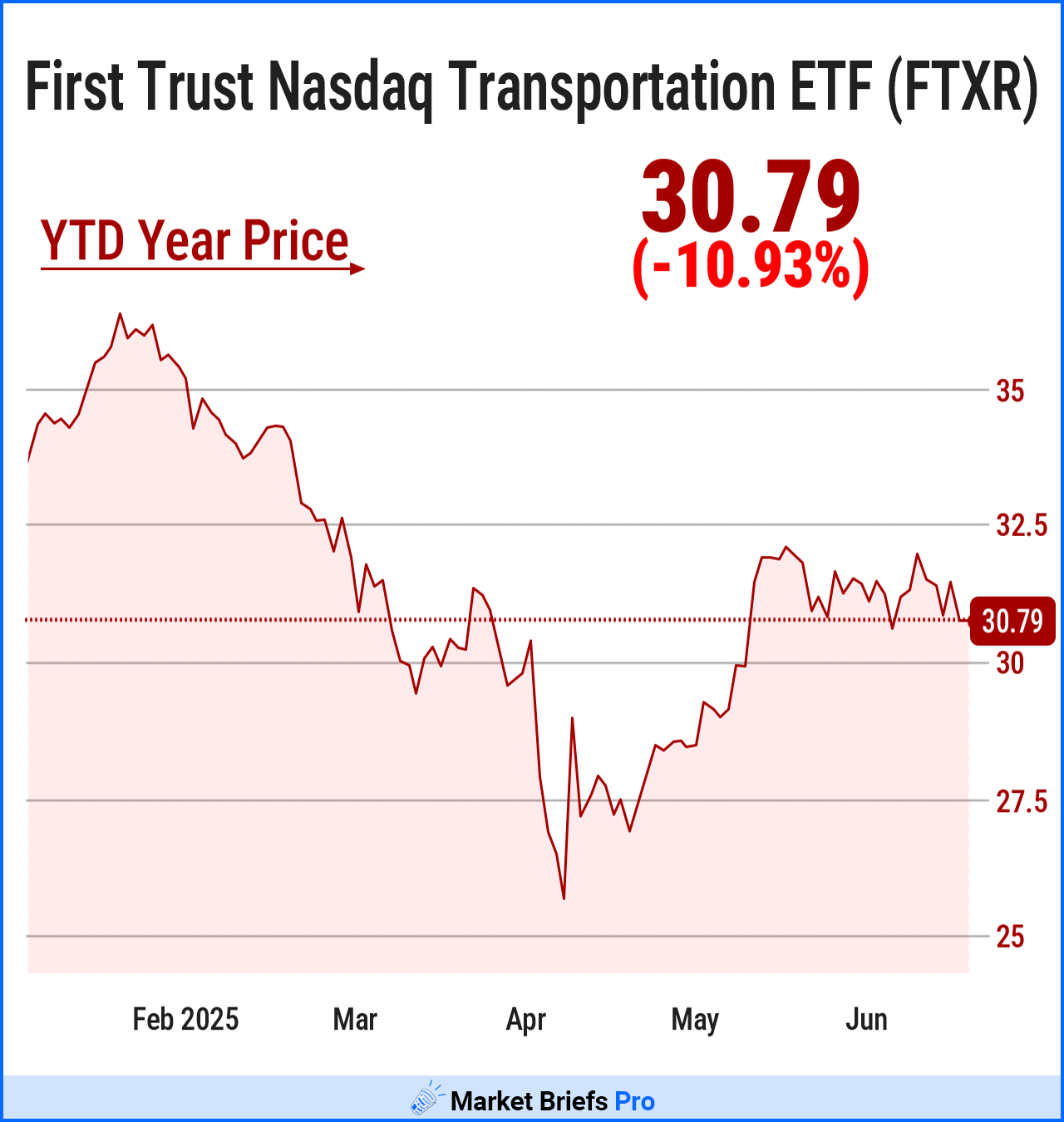

At their core, drone taxis are transportation companies. As such, these stocks can both be found in the First Trust Nasdaq Transportation ETF (FTXR). |

|

Data via Yahoo! Finance |

|

|

SURVEILLANCE |

Digital Eye in the Sky

Drone taxis might be the technology of tomorrow, but some aspects of the commercial drone industry have been around for years.

One of the most common uses is drones for surveillance and monitoring.

Whether you’re keeping an eye on powerlines, mapping out a mountain, or law enforcement tracking a crowd, drones have become a go-to technology for anyone who needs an aerial view.

|

|

|

Image via India Times |

|

Surveillance is one of the areas where drone design is somewhat similar between military and commercial use, so it might be unsurprising that there’s some overlap between the companies making them.

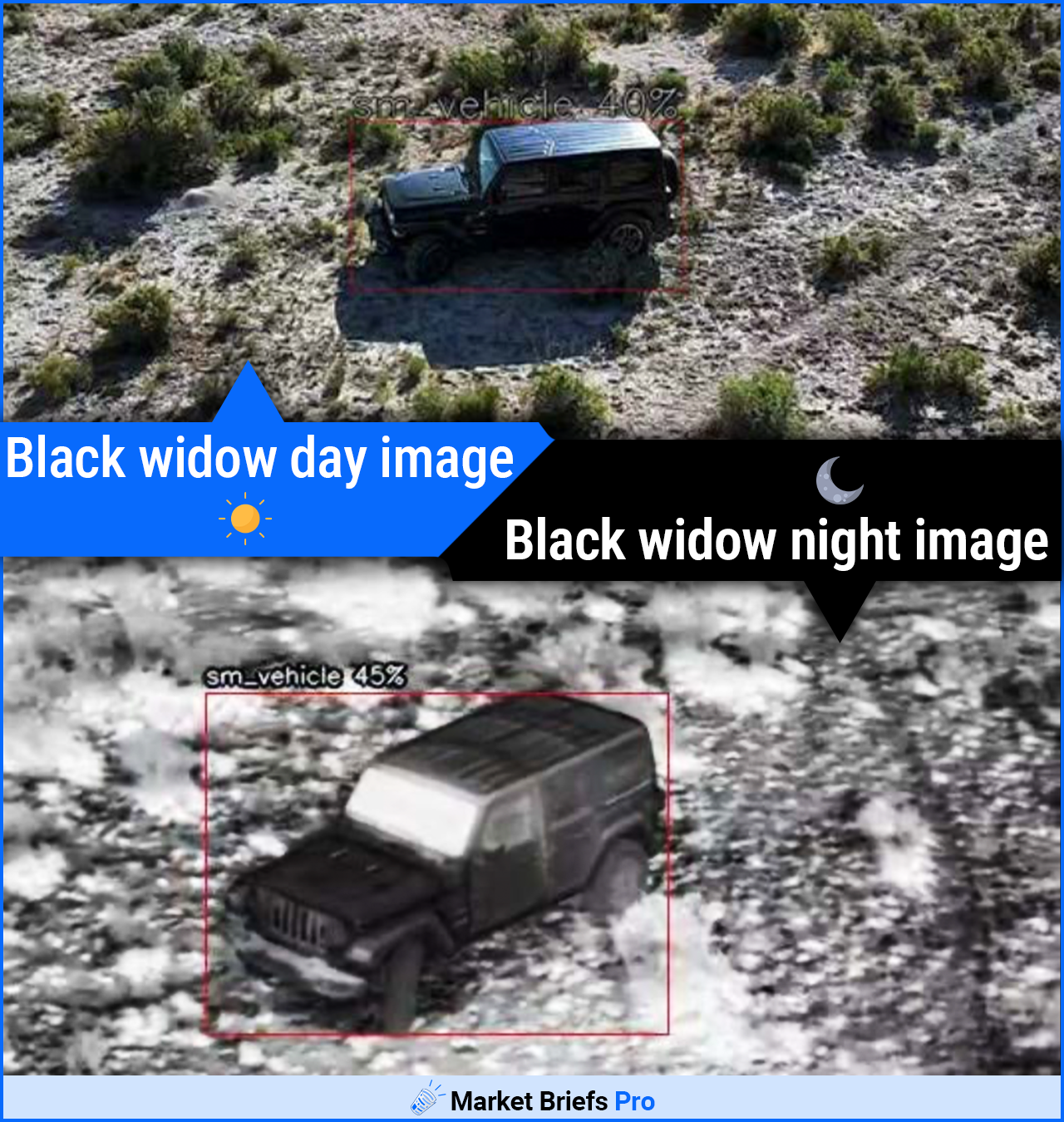

One of those companies is Red Cat Holdings (RCAT) which makes both surveillance drones for the Army as well as popular commercial models.

Red Cat has looked to innovate by partnering with companies such as Palantir (PLTR) to incorporate AI into their drones, which would make it easier to fly long distances.

They iterate on their more successful military business segment, then bring those new technologies to their commercial offerings. |

|

Image via Red Cat |

|

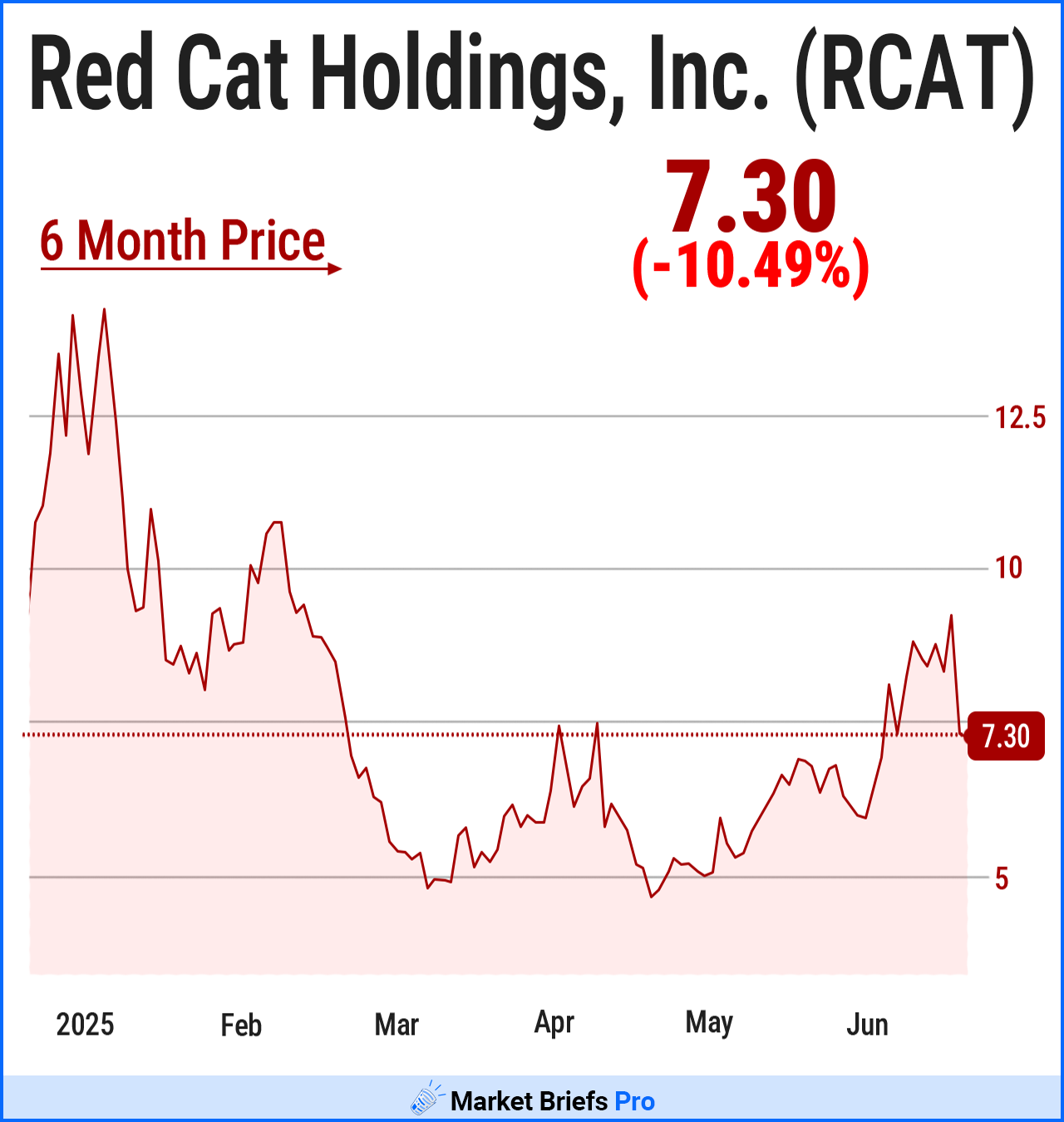

Red Cat’s business has struggled over the past few years.

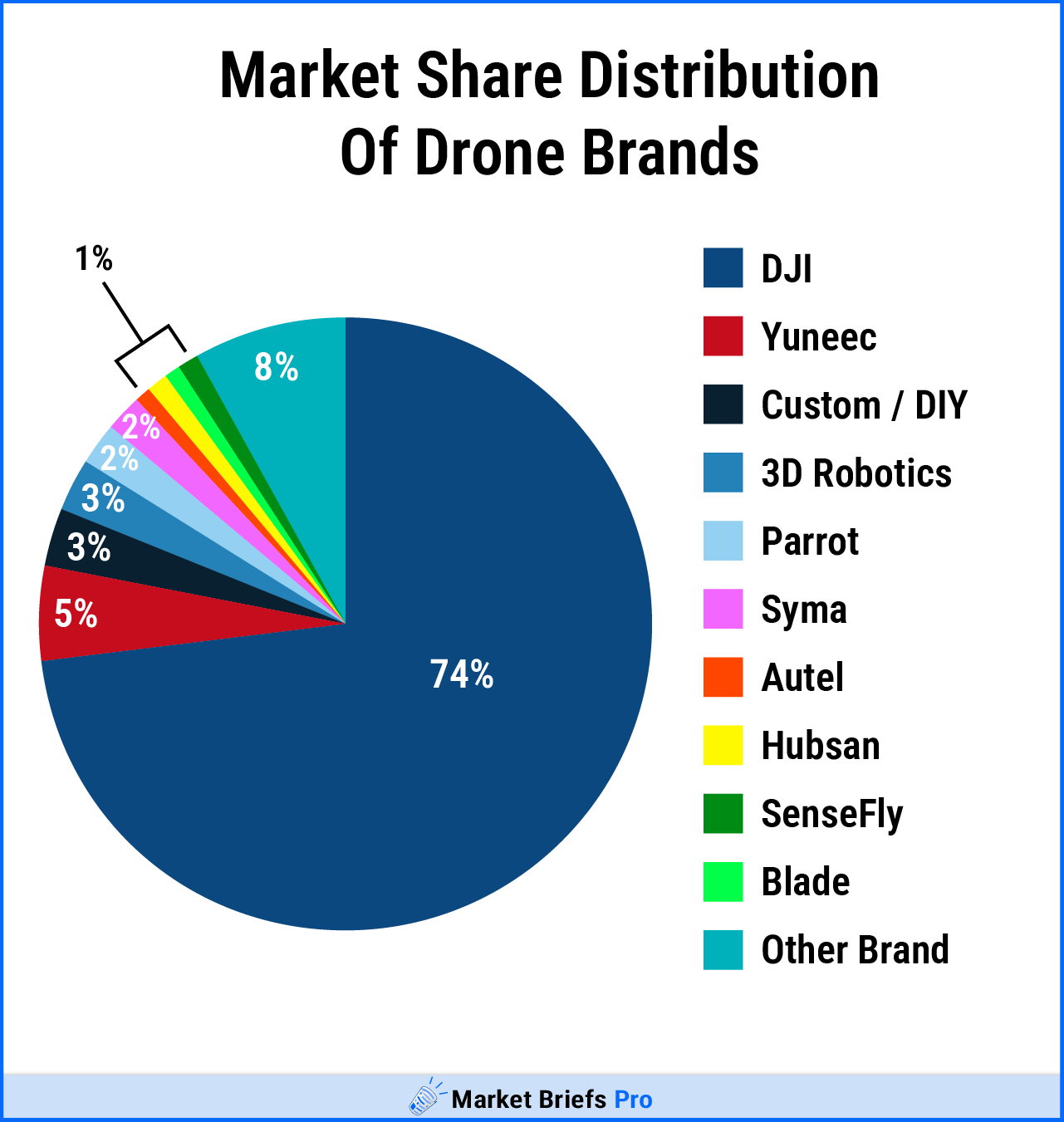

The big reason? The Chinese drone market.

|

|

Data via Skylogic Research |

|

Michael Healander described the Chinese drone market as being so dominant that many consider it to be a national security risk.

And as a result, Red Cat has struggled to build revenue, and their share price has suffered as a result. |

|

Data via Yahoo! Finance |

|

But company share prices went up on June 6th, and the President’s drone initiative might have other good news for companies like Red Cat.

Michael also told our analysts that the President is looking towards a 100% tariff on Chinese drones, and that for years, there have been talks about a total ban on Chinese drones.

So what’s stopping a ban? Currently, law enforcement relies heavily upon Chinese drones, and replacing all of them would cost an enormous amount of money.

Even without a ban, new policies favoring U.S. drone makers could mean big money for companies like Red Cat

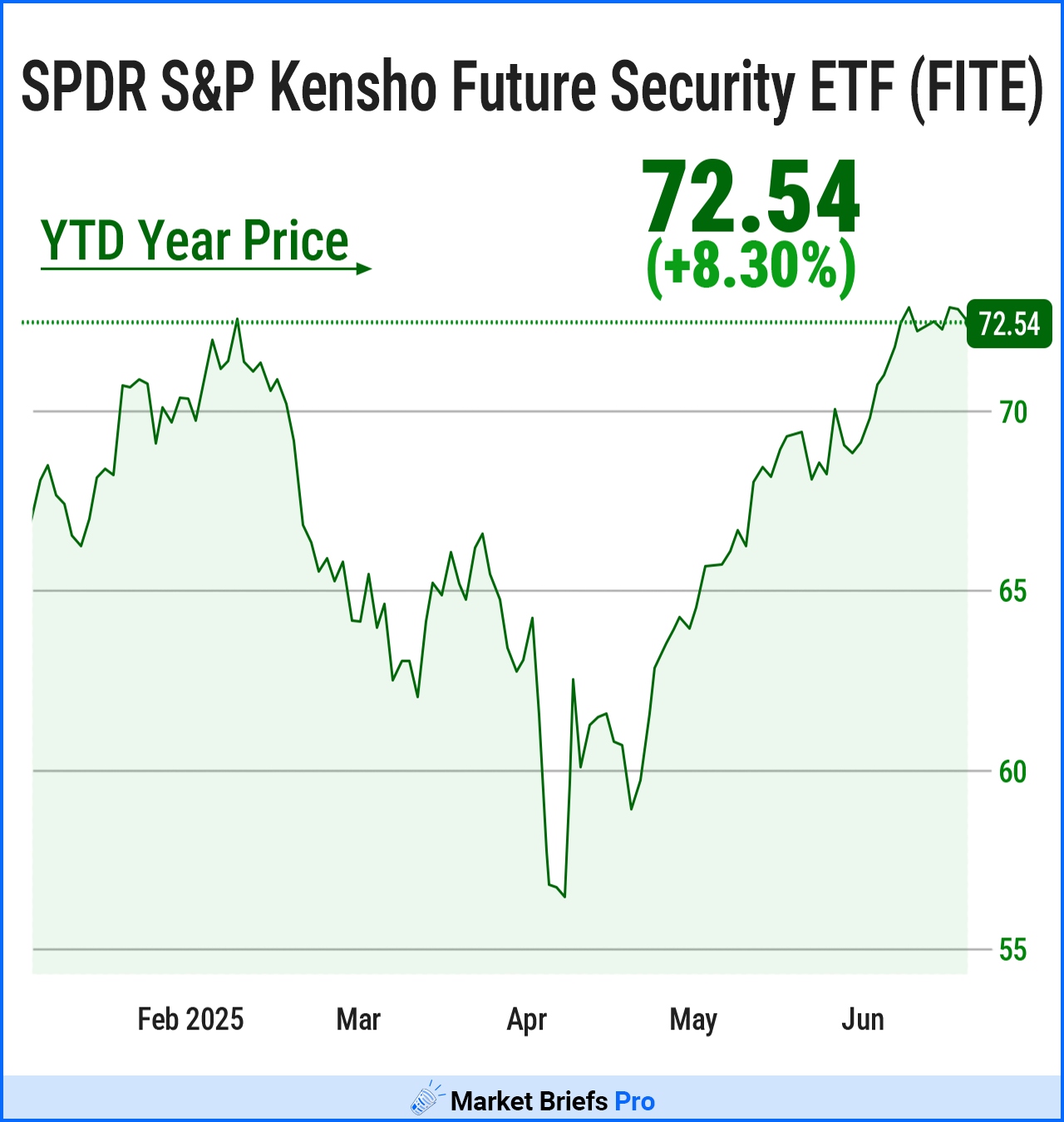

With their military roots, many of these companies (including Red Cat) can be found in the SPDR S&P Kensho Future Security ETF (FITE). |

|

Data via Yahoo! Finance |

|

|

AGRICULTURE |

Cultivating an Industry

While its connection to military tech makes surveillance a longstanding drone industry, one of the largest and fastest growing is agriculture.

Michael described that agriculture has been one of the biggest pushes in the drone industry, because it’s been a long-standing black mark on the safety record of the FAA.

By moving things like seeding and crop dusting away from small fixed-wing planes and into drones, the industry can help drastically reduce the number of aviation deaths.

Recent developments have also let drones excel at things like monitoring soil health and the moisture in crop fields.

|

|

Image via UAS Weekly |

|

As a rapidly growing segment of the low-altitude economy, the business landscape for agricultural drones is changing fast.

While larger companies such as Deere & Company (DE) and Trimble (TRMB) have drone segments, there could be a major opportunity in small, ambitious, drone-focused companies in agriculture.

AgEagle has quickly established itself as a major player in drone agriculture, providing multiple models.

|

|

Data via Yahoo! Finance |

|

AgEagle is a microcap company, with a market cap just over $17 million dollars.

Like many companies in the drone industry, had been on a steady decline until the executive orders were signed.

While AgEagle could ride the wave of these orders into success, they could also be the potential target of an acquisition.

Acquisitions have become extremely common in the agricultural drone industry.

|

|

Image via Raven 6 Rising |

|

CNH is a major manufacturer of all things agriculture, and their acquisition of Raven Industries makes them a force in the drone industry as well.

|

|

Data via Yahoo! Finance |

|

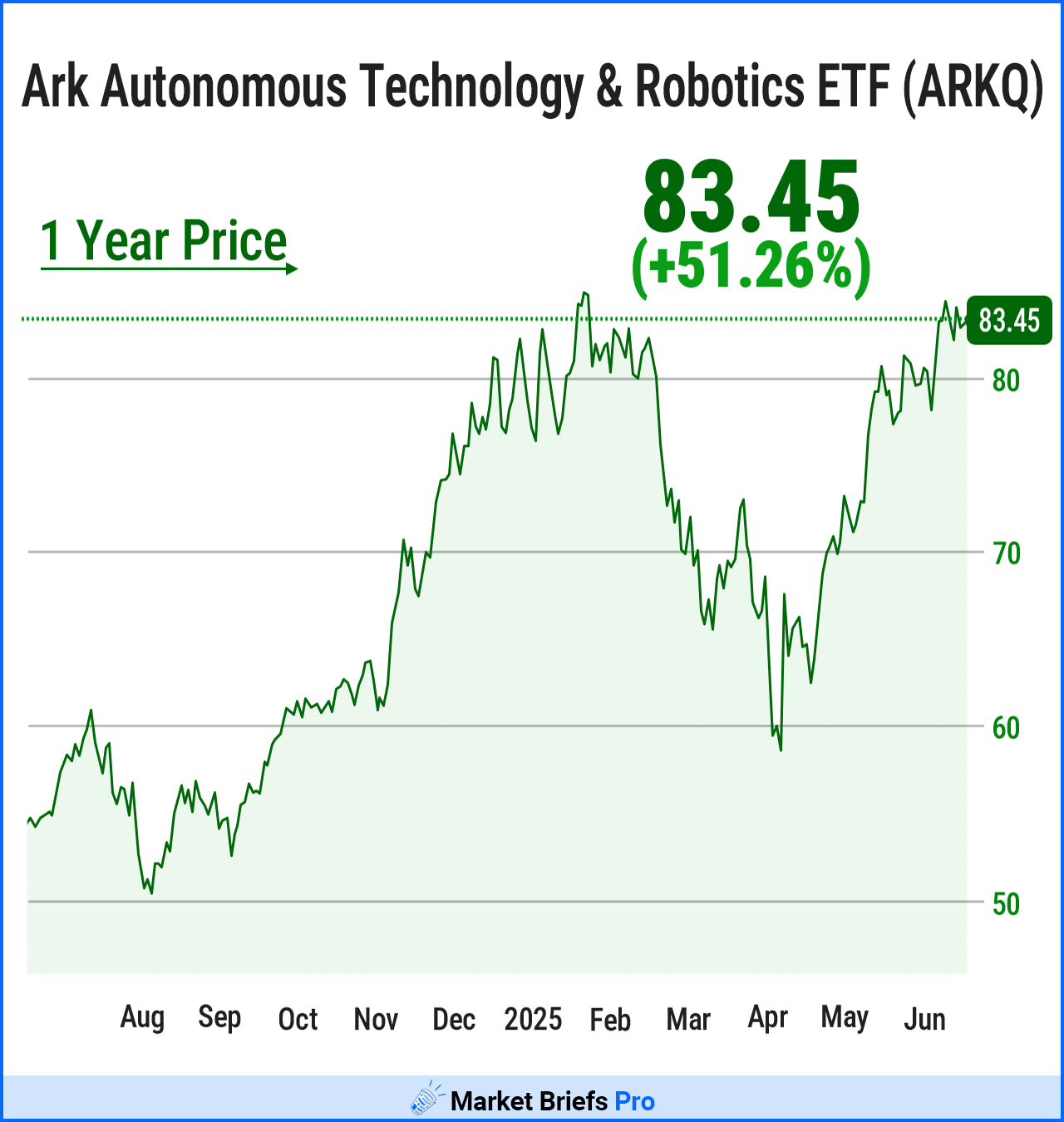

Many of the agricultural drone companies can be found in the ARK Autonomous Technology & Robotics ETF (ARKQ) |

|

Data via Yahoo! Finance |

|

|

RISKS |

Too Early To Tell

The drone industry and emerging low-altitude economy aren’t without risks.

Drones pose some inherent danger to society - Neil Sahota described the UN’s difficulty in classifying drones, because all of them are potentially lethal.

And CEO Michael Healander expressed a similar sentiment, stating that the best they could do is provide close monitoring of 95% of drones in the air, so law enforcement would only have to worry about the other 5%.

Neil expressed concerns that different regions, such as cities or states, running different software, could cause communication problems between drones, and potential crashes.

And the industries themselves are growing quickly alongside the executive orders, but few of them are established and commercially viable.

When asked about drone taxi services, Michael said they would happily serve that industry with their technology, but he just “wasn’t seeing it” in the immediate future.

|

|

|

REVIEW |

|

An Emerging Economy

While we don’t know what the drone industry will look like in a few years, all signs seem to point to mass drone adoption.

The executive orders signed by President Trump have specific markers, with major updates at the 30, 60, and 120-day markers.

Industries like agriculture and surveillance are already in the sky, and others like drone delivery and drone taxis could be just weeks away from takeoff.

Investors should keep a close eye on these companies and updates from the government as regulation takes shape.

|

|

|

|

|

- Briefs Media Team

Subscribe to Market Briefs here.

*The Briefs Media team often invests in the same stocks and assets we cover.

Why? Because we believe in practicing what we preach (and preaching what we practice).

But keep in mind: We’re not financial advisors. Everything we provide is for education. You’ve got to do your own due diligence and think about what makes sense for your own financial situation. Investing has risks.

You are never guaranteed to make money when you invest, you might even lose money. If you’re looking for personalized financial advice, we highly recommend speaking with a licensed financial advisor.

Our mission? It’s simple - to help you be better with money. |

|

|

|

|